Rushed land deals and a push for quick delivery characterise a solar tender in which Chinese companies were involved in winning bids for all but one of 30 sites.

By KYAW YE LYNN and THOMAS KEAN | FRONTIER

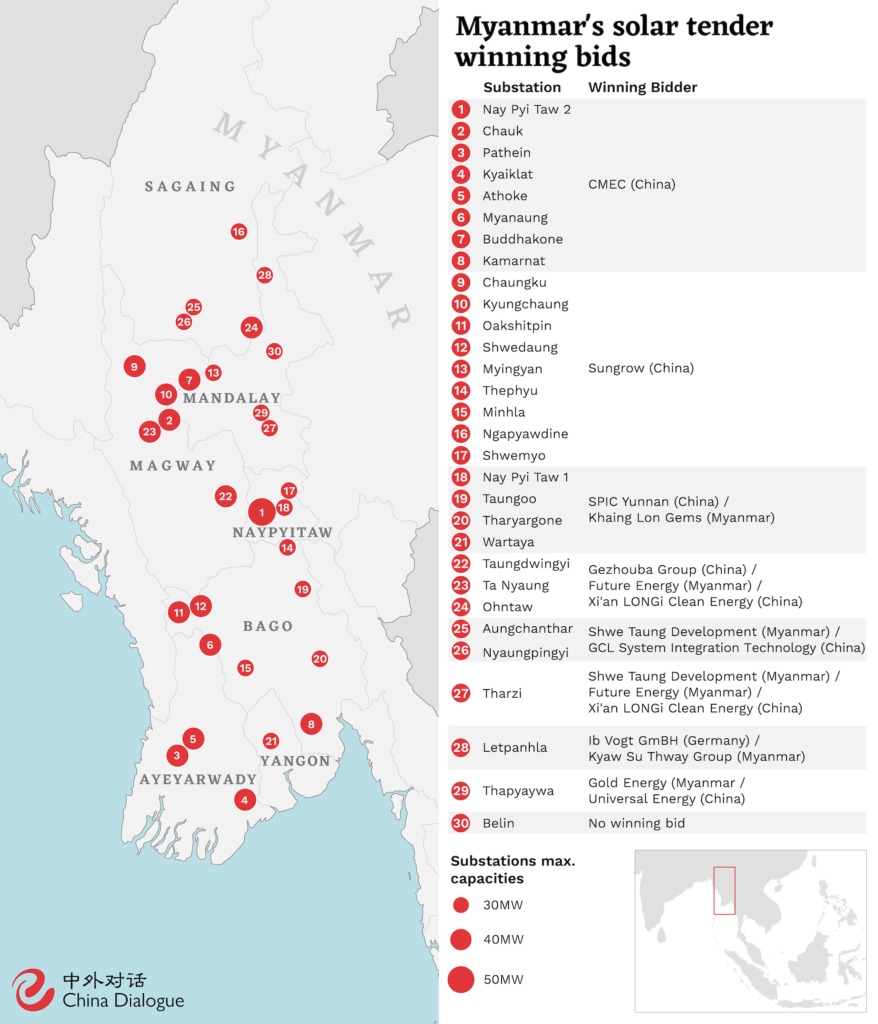

When bids were opened in Myanmar’s 1.06-gigawatt solar power tender on September 9, a few names were repeated over and over: Sungrow Power Supply Co Ltd, China Mechanical Engineering Corporation, State Power Investment Corporation, China Gezhouba Group and Xian Longi Clean Energy Co Ltd.

In the end, all but one of the winning bids for the 30 sites, which will range in size from 30 to 50 megawatts, involved Chinese companies. The winners were decided based on price alone from among those that passed the technical criteria. Sungrow claimed nine sites and CMEC eight, while the most successful Myanmar firms were Shwe Taung Group and Khaing Lon Gems, which both worked with Chinese partners.

The winning bids ranged from 3.48 US cents per kilowatt hour to 5.1 cents – far below Myanmar’s average cost of supplying power, which was the equivalent of 8.1 cents in early 2018 and has only risen since.

The ministry has already started negotiations on the power purchase agreement (PPA) with the first-ranked bidders, and letters of acceptance should be issued by early October according to the schedule in the tender documents.

The PPA only has to be signed within 150 days of the letter of acceptance issue date, but the tender rules also say that if the ministry cannot finalise the PPA with the first-ranked bidder within 15 days, it will start negotiating with the second-ranked bidder.

Unexpected Chinese bids

The result had been widely anticipated since it emerged Chinese companies had submitted the majority of proposals received by the 17 July deadline, but it is understood this left even Ministry of Electricity and Energy officials uncomfortable.

An official from the ministry’s Hydropower and Renewable Energy Section said the ministry had been expecting bids mainly from companies that had previously submitted direct proposals, particularly firms from Western countries, Japan and Thailand.

“Honestly, we are as surprised as anyone to learn that Chinese companies had dominated the bidding because they hadn’t shown much interest in [solar] projects before,” he said.

Unusually, most of the winners do not have significant experience as independent power producers: Sungrow is an inverter manufacturer, for example, while Longi makes solar panels. CMEC specialises in engineering, procurement and construction (EPC). “How can we compete with our own panel suppliers?” questioned one person, whose consortium’s proposal was significantly higher than the winning bid.

Under the tender rules, bidders only needed to show they had “developed and/or constructed” three power projects in the past 10 years, including one with photovoltaic technology.

The ministry’s lack of familiarity with many of the bidders and its concerns over whether they were qualified meant the screening process took much longer than anticipated, the official said. In the end, bids were opened more than 50 days after submission, rather than the 20 days indicated in the tender guidelines.

“The tender selection committee also didn’t expect so many Chinese companies to bid and then they were aware of their lack of experience building and operating power projects,” he said. “I think the committee delayed the announcement because they needed more time to look into the background of the companies that passed the technical criteria.”

U Than Naing Oo, the managing director of the Electric Power Generation Enterprise, which ran the tender, had not responded to a request for comment before publication.

A senior official at the Department of Electricity Power Planning confirmed the selection process had been “a headache” compared to previous tenders for gas-fired projects.

“With the liquified natural gas tenders [in 2019], the ministry knew the winning companies very well because it had worked with them before,” he said. “But the lowest bid prices [for the solar projects] are from companies that don’t have much experience building or operating power plants. It made the selection committee nervous.”

He said the committee spoke to the bidders and in the end was satisfied with their plans for project financing, implementation and operations.

“From what I understand the idea is for the winning bidders not to do it themselves, but to bring in other contractors to build and operate the projects,” he said.

Under the terms of the draft PPA, the consortium cannot transfer more than 49 percent of the project to another entity within four years of commencing operations. The official suggested that the ministry might show some flexibility when negotiating the final PPA.

“I don’t think this will be a problem. In our country, you can’t follow the rules and regulations all the time, you act according to the situation. In this case, the ministry wants cheap electricity. The Chinese firms have offered it … the ministry would have preferred Western companies if the prices were the same, but they are very expensive,” added the official.

An industry insider working for a Chinese energy conglomerate said the bidding result “shows that Chinese companies are responsive and risk-taking in renewable energy ventures. It reflects the mature supply chains and business models behind the Chinese renewable energy industry’s overseas expansion.”

“As more Southeast Asian countries open their markets for renewables development, Chinese companies will have more opportunities to get involved in the region’s low carbon energy transition,” he added.

Nevertheless, the background of the bidders is likely to fuel accusations that they are seeking to offload old inventory. A slowdown in solar installations in China has led to a supply glut for components. This has prompted the Chinese authorities to propose restrictions on the further expansion of manufacturing capacity.

Chinese firms may not have huge experience in foreign solar markets, according to Mr Tim Buckley, director of energy finance studies at the Institute of Energy Economics and Financial Analysis, but “China has been the world’s largest investor domestically in solar every year since overtaking Germany at the start of the decade. And it is not like a solar project is a complex engineering feat,” he said.

He added that smaller, modular renewables projects such as solar farms “tend to bring competitive tension and transparency, all but squeezing out the endemic corruption evident in major traditional fossil fuel power projects.” However, he said the recent tender’s “lack of bidder diversity is far from ideal for Myanmar in terms of building capacity for subsequent, even lower cost, renewable energy tenders.”

A flawed tender process

The large number of bids submitted was surprising in part because of the tender design, which did little to encourage competition. EPGE announced the tender in May at the height of the COVID-19 pandemic, and gave prospective bidders just a month to prepare bids. The requirement that they procure land, at a time when many parts of the country were inaccessible due to travel restrictions, drew sharp criticism.

According to three sources familiar with the situation, including one ministry official, the aim of the tender was to solicit new bids from companies that had previously proposed projects directly to the ministry. The ministry did not anticipate that anyone would be able to challenge those bids, the sources said.

“Some people have already submitted proposals and they already have the land,” one bidder said in May, shortly after the tender was announced. “So this tender is like a challenge to other bidders to match them.”

But after an outcry from the Western business community in Yangon, the ministry pushed back the deadline a month, to mid-July. This may have opened the door for Chinese companies to participate. In early June, Myanmar and China agreed on a “fast-track lane” to enable Chinese businesspeople to enter the country, at a time when nationals from most other countries were struggling to enter. “Through this mechanism, personnel on critical posts of oil and gas, electricity and infrastructure projects have travelled back and resumed work,” Chinese Ministry of Foreign Affairs spokesperson Zhao Lijian said at a press conference on June 15.

It wasn’t just the deadlines and land acquisition requirements that put off prospective investors. The draft PPA is also unworkable for Western investors pursuing traditional project finance, due to ambiguities over take-or-pay provisions and other issues. The project timeline, including a 180-day deadline to commence full operations, is also considered hard to meet. It would require investors to build their solar plants at the same time as they are negotiating the PPA, making it almost impossible to access normal project finance.

But the ministry’s permanent secretary for electricity, U Soe Myint, insisted on September 17 that the tender had been a success for the country.

“There were many criticisms about the tender rules, mainly on the deadline for bid submission, but we did it like that in order to get these projects online as quickly as possible,” he said by phone from Nay Pyi Taw.

“I think the result has silenced the criticism. A lot of foreign firms bid for projects and it was, I think, very competitive. We also got relatively fair prices,” he said, declining to answer further questions.

‘Everyone was looking to secure land’

The announcement of the tender in May sparked a land acquisition frenzy, as companies sought to buy or lease hundreds of acres of land as close as possible to the 30 designated connection points in order to submit compliant bids.

Many of the proposed sites are in central Myanmar’s dry zone, where land is often unsuitable for agriculture and solar irradiance high, even during the rainy season.

In Mandalay Region’s Thazi Township, which hosts two proposed projects – Thazi and Thabyaywa – locals told Frontier that brokers, middlemen and company staff had descended on the area shortly after the tender was announced.

“June was a very unusual month,” said a real estate agent from Thazi, who spoke on condition of anonymity. “A lot of people came to Thazi looking for land. Some were Chinese and Indians but most were Myanmar – either staffers of foreign firms or middlemen. Some wanted to buy, others wanted to lease… The transactions were very unusual.”

One Chinese company asked him to find more than 130 acres near Thazi sub-station, but after several days of searching he gave up. “Most land around Thazi is irrigated farmland, so the prices are high – around K4 million to K5 million (US$3,000 to $3,700) per acre – and not many people are willing to sell.”

Administrators from several village tracts to the east of the town, not far from the sub-station, told Frontier in early September that there had been strong interest but concluding deals had been difficult.

Zee Pin Pauk administrator U San Tun Aung said the village received many brokers in June and July, including some accompanied by foreigners. “Some villagers were willing to work with them, but the problem is they have to secure about 150 acres of contiguous land,” he said in an interview at his brother’s cattle farm.

The agent instead managed to arrange a land lease agreement with residents of Myo Gyi Kone, close to the Thabyaywa sub-station, on behalf of Spanish company Enerland and local partner Myanmar Infinite Energy. The land there is less fertile, and locals were happy to accept offers.

More than 40 farmers leased around 130 acres in an area called Myo Gyi Kwin South to the consortium for 15 years. Kwin is a Burmese word for field or plain, and Myo Gyi Kwin is the name given to the more than 1,000 acres that surrounds the village of Myo Gyi Kon. The different part of Myo Gyi Kwin are referred to as north, east, south and west.

The farmers agreed a price of K1.8 million ($1,362) per acre, but the company only had to provide K30,000 ($23) an acre initially, and would pay the rest if it was selected.

The differing quality of the land is reflected in the number of bids: the Thabyaywa project attracted 12 overall – second only to Ta Nyaung in Magway Region, with 13 – while Thazi had only seven, despite being nearby.

“The plan was to lease our land for 15 years with a possible extension of 10 years,” said U Than Tun, a resident of Myo Gyi Kone who leased 18 of his 25 acres. “The land isn’t fertile, so I’m happy to get something for it.”

However, a few days before Frontier’s visit, residents had already been informed by the agent that the full deal was cancelled, likely because the consortium had not passed the technical criteria.

Myo Gyi Kone residents said that several agreements were reached in June for large parcels of land, apparently for solar bids. A woman named Daw Phyu Phyu Myaing purchased more than 100 acres in Myo Kyi Kwin West, agreeing to pay K800,000 to K1.1 million ($600 to $830) per acre, residents said.

U Than Chaung sold seven of his 20 acres to Phyu Phyu Myaing, receiving an initial payment of K130,000 ($98) per acre and providing her a copy of his land-use certificate. “We should have received the final payment in mid-August, but Phyu Phyu Myaing requested us to extend the deadline to the end of August,” he said.

As of September 3, Than Chaung and other residents were yet to receive the final payment from Phyu Phyu Myaing, and they considered the contract to be void. “We don’t know why they wasted their money this way,” Than Chaung said.

Phyu Phyu Myaing, though, almost certainly has no intention of completing the sale. She is a director of Royal Ace Trading, a Myanmar company that bid unsuccessfully for four sites, including Thabyaywa, together with PCS Machine Group Holdings, a Thai company.

Trouble for winning bidders?

With the first-ranked bidders now announced, the land deals they quickly hashed out in June and July are likely to come under much closer scrutiny.

That could leave some in trouble, opening the door for bidders further down the list to take over.

At Thabyaywa, a consortium of Myanmar’s Gold Energy – a subsidiary of the Asia World conglomerate – and Shanghai-based renewable energy firm Universal Energy submitted a bid for 3.95 cents per kilowatt hour, just edging out the consortium of SPIC Yunnan International Power Investment and Primus Advanced Technologies.

But Myo Gyi Kone residents say the land that Gold Energy used for the bid was owned by the community and had been quietly sold off without their knowledge.

Unlike Enerland and Royal Ace, Gold Energy acquired land in Myo Gyi Kwin East, which covers more than 200 acres and is used as pasture. “We used to grow a variety of crops when we were young,” said U Thar Ya, a resident in his 80s.

He said that farming had become impossible on Myo Gyi Kwin East about 35 years ago due to changes in the climate that had decreased rainfall and increased the frequency of floods.

“It forced us to shift from farming to other businesses,” he told Frontier on September 3, as he sat with other residents under a tree near the entrance to the village.

Later, the plain provided a raw material used to make soap, which the Ministry of Industry produced at a factory in nearby Yamethin. As a result, locals colloquially called the area satpyar kwin, or soap field.

“[A private company] extracted the raw material for nearly two decades here. In those days, the whole kwin was crowded with people and light machines working day and night,” Thar Ya recalled.

This extraction ended around 2011 when production began to decline and it became easier to import raw materials from abroad. Locals thought that the company abandoned the land, because it has been unoccupied ever since.

In recent years, cattle breeding has become the main business in the area. In late 2017, Myanmar permitted live exports of cattle, sparking a boom in sales of livestock to China and creating new demand for pasture. Myo Gyi Kwin is now home to around 4,000 cattle, residents said.

But then, in early June, residents were shocked to learn that a large chunk of Myo Gyi Kwin East had been sold to a bidder in the solar tender.

An official from the Department of Agriculture Land Management and Statistics in Thazi confirmed that Gold Energy purchased 133.34 acres in early June.

“As far as I know, Asia World intends to use it for a bid for the Thabyaywa solar power project,” the official, who spoke on condition of anonymity, told Frontier at a teashop in central Thazi.

He said there had been many land transactions in Thazi since the tender was announced in May, but the buyers were not obligated to inform the department. It only became aware of Gold Energy’s purchase because Myo Gyi Kone residents had disputed the transaction.

More than 100 residents signed a complaint letter and sent it to the Mandalay Region government, as well as relevant government departments. The letter called on the authorities to review the ownership of 121.66 acres that Gold Energy had purchased on June 13 from seven individuals who the petitioners said were outsiders.

The land records official said land use certificates, which signify land ownership and are known in Myanmar as “form seven” in the case of farmland, had been issued to seven individuals in late 2013, about a year after the Farmland Law was enacted. He added that there was no record of residents having objected to the issuing of the certificates to the seven individuals.

However, Myo Gyi Kone residents said government officials had failed to inform them about the application for land ownership at the time.

“We had zero knowledge that the land had been registered by people who don’t live here. We just assumed that Myo Gyi Kwin East remained vacant land under the management of the government,” Thar Ya said. “This pasture is essential for our livelihoods – without it, we won’t be able to continue breeding cattle.”

Gold Energy’s corporate communications director Ko Chris Lone said the company had purchased the land from verified owners and was not aware of any ownership dispute. He declined to comment further.

Hurried environmental checks

Bidders have also been left confused as to the rules regarding environmental assessments, which are often a bottleneck on major construction projects and could pose a serious obstacle to meeting the six-month deadline for beginning full operations at the solar plants.

Myanmar’s environmental permitting system is relatively new, with the relevant procedures only introduced in 2015. A backlog of Environmental Impact Assessments (EIAs) and initial environmental examinations, which are for less sensitive undertakings, has previously delayed the issuing of environmental compliance certificates (ECC) that are required to commence activities. In practice, many companies have begun construction without ECCs or even without conducting any impact assessment at all.

Under the EIA procedure, solar projects below 50MW are not required to have an initial environmental examination, while an EIA is only necessary if the Ministry of Electricity and Energy requires it.

Confusingly, the draft PPA for the tender says the company shall prepare an environmental and social impact assessment (ESIA) for the project “in accordance with the requirements and regulations of the Ministry of Natural Resources and Environmental Conservation”, despite nearly all the projects in the tender being under 50MW.

The rules state that the ESIA should be prepared in accordance with the “performance standards” of the International Finance Corporation, a member of the World Bank Group that has provided technical assistance to the Ministry of Electricity and Energy on a model PPA.

U Kyaw San Naing, a director at the ministry’s Environmental Conservation Department, said it takes the department up to two months to review a single EIA and it would be difficult for it to review 30 EIAs concurrently in such a short period.

“In order to review an EIA, we have to form a team with members from relevant government departments,” he added.

He said however that the review process would be quicker in this case because solar projects generally have a limited impact on the environment. The ministry would also prioritise the solar plants because they are state-backed, he said.

He added that some preparatory works can be done while waiting for an ECC.

“Some basic steps,” he said, “such as land clearing and making fences can take place prior to receiving approval.”

This article is co-published with China Dialogue and can be read on their website in English and Chinese.